W4 paycheck calculator

It can let you adjust your tax withheld up front so you receive a bigger paycheck and smaller refund at tax time. Then complete Steps 1a 1b and 5.

Paycheck Calculator Online For Per Pay Period Create W 4

1 Loan approval is subject to meeting the lenders credit criteria which may include providing acceptable property as collateral.

. To claim exemption from withholding certify that you meet both of the conditions above by writing Exempt on Form W-4 in the space below Step 4c. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Payroll check calculator is updated for payroll year 2022 and new W4.

It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions. Withheld from your paycheck and may owe taxes and penalties when you file your 2022 tax return. Our free W4 calculator allows you to enter your tax information and adjust your paycheck withholding to increase your refund or take-home pay on each paycheck by show you how to fill out your 2020 W 4 Form.

Maximize your refund with TaxActs Refund Booster. There is no head of household status for withholding formulas. This federal hourly paycheck calculator is perfect for those who are paid on an hourly basis.

See State Disclosures for additional information. Do not complete any other steps. Your marital status determines which formula your employer will use to calculate the tax to be withheld from your paycheckThis is because the tax rates and standard deduction amounts are different depending on whether you are married or single.

Switch to hourly calculator. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free federal paycheck calculator. The Tax Withholding Estimator doesnt ask for personal information such as your name social security number address or bank account numbers.

All loans will be serviced by LoanMart. You will need to. LoanMart is currently not lending in California and does not make loans or credit.

Actual loan amount term and Annual Percentage Rate of the loan that a consumer. Adjust your W-4 withholdings to get a bigger tax refund or a bigger paycheck. IRS tax forms.

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Ca Appstore For Android

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Template Download Printable Pdf Templateroller

Payroll Tax What It Is How To Calculate It Bench Accounting

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Pennsylvania Income Tax Calculator Smartasset

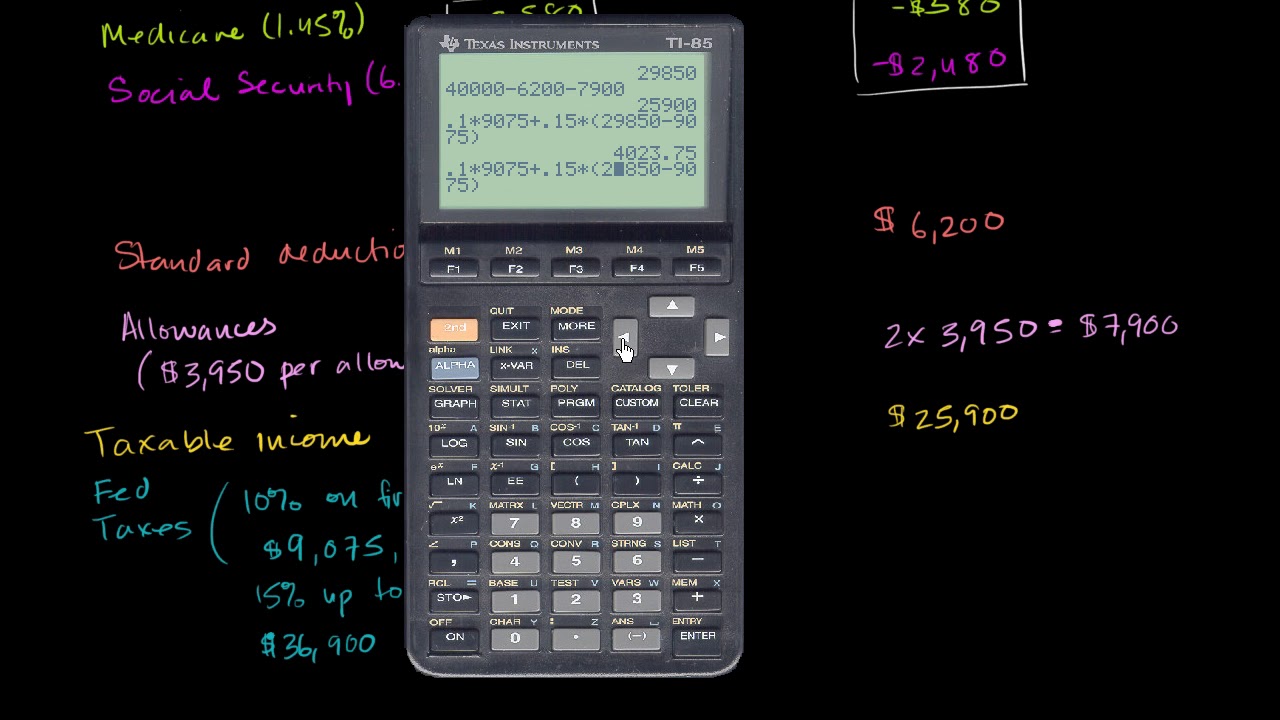

How To Calculate 2021 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Impact Of W 4 Allowances On Paycheck Video Khan Academy

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Salary Paycheck Calculator How Do You Calculate Your Take Home Pay Marca